UK Securitisation Repository Reporting – The First Six Months in Review

Six months have already passed since the Financial Conduct Authority (FCA) announced the registration of the first UK Securitisation Repositories, with reporting entities required to switch from ESMA to FCA data templates and XML schema in order to meet their disclosure obligations.

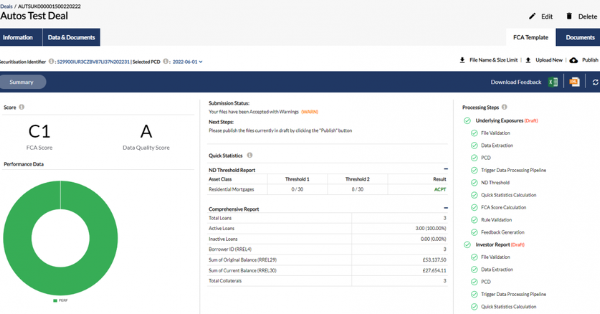

Prioritising Data Quality

In anticipation of a spotlight being focused on the quality of loan-level data supplied, European DataWarehouse (EDW) has taken steps to help reporting entities improve data quality. In addition to the mandatory FCA rules new supplementary data quality rules and scoring, were implemented, highlighting issues so they may be resolved prior to submission.

Simplified Dual-Upload Requirements

EDW has noted another area of market discussion for UK issuers related to the fulfillment of transparency requirements for UK transactions with EU investors, or with one of the relevant transaction counterparties domiciled in the EU.

While each transaction may have its own specific legal quirks, uploading relevant structured data for underlying assets and transaction-level information to EDW’s UK EDITOR platform is in most cases sufficient, this data is automatically mirrored to the to the EU Securitisation Repository platform (EU EDITOR).

As such, EU investors or other relevant counterparties can conveniently meet their due-diligence requirements by automatically accessing the relevant data through an EU website. Furthermore, UK issuers can upload ESMA templates to the UK Repository as separate documents if necessary.

Increased Activity in Private RMBS Transactions

Despite the UK RMBS market being traditionally driven by public securitisations, EDW has observed increased activity in private transactions for this asset class.

In light of this, EDW has enhanced its Private Area Solutions which provide an efficient and audit-proof reporting infrastructure, specifically in cases involving transactions and/or counterparties. This solution can also be offered on a full outsourcing basis if requested.

New Mortgage Trends on the Horizon?

Interestingly, a trend toward longer term mortgages appears to be on the horizon, with terms of up to 50 years, on a 30-year fixed rate, now a possibility. How such conditions will affect the securitisation market remains to be seen, as will the increase in green mortgages and the impact these will have on disclosure.

For deep dive into all things relating to the UK mortgage finance area and the RMBS asset class, don’t miss Deal Catalyst’s Investors’ Conference on UK Mortgage Finance from 6-7 September in London.

As a lead sponsor, EDW can offer interested originators and investors to join the conference for free. Click below to register, using the promo code EDW_VIP. Please note, free passes are subject to review and approval based on Deal Catalyst’s qualification criteria. These criteria are specified on the registration page.