RMBS Amortisation Rates Show Signs of Return to Pre-COVID Levels

Throughout the COVID-19 pandemic, European DataWarehouse has utilised its vast loan-level database to provide insights into loan performance across various asset classes in Europe.

In the RMBS asset class, for example, a previous EDW Q1 2021 analysis shows that delinquencies remained low during the COVID-19 crisis. Despite this, however, there has been a clear impact on amortisation patterns of mortgage loans due to the implementation of payment holidays, which were utilised in many countries to avoid a wave of defaults.

Quarterly Amortisation Patterns of European Mortgages in Focus

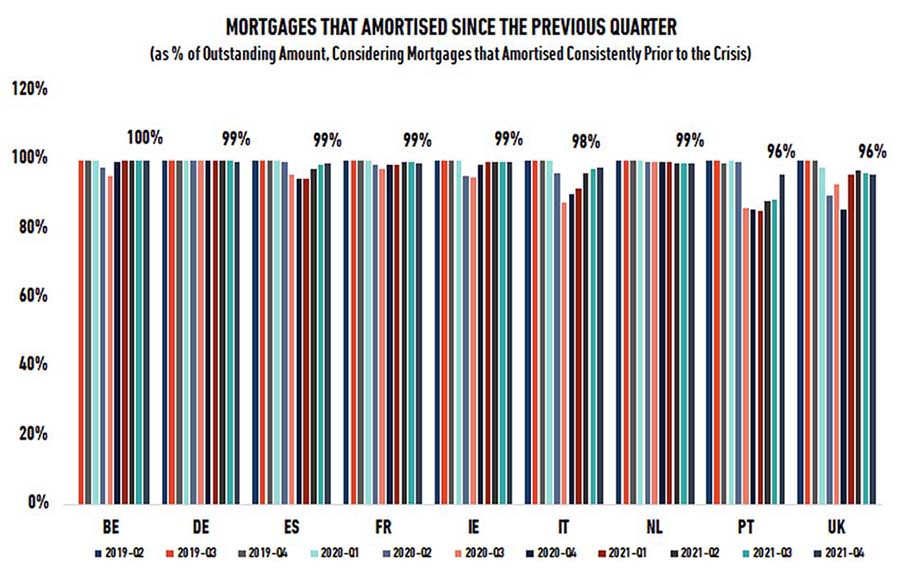

In this blog we focus on the proportion of loans (by outstanding amount) that amortised in each quarter. The chart below represents only those loans that reported consistently over the last three years and had amortised regularly prior to the crisis (loans that had amortised in 2019).

Using the same methodology, we updated the results to Q4 2021 as published in the annual Hypostat report 2021 (see page 11).

Pace of Amortisation Rate Recovery Differs across Europe

In most countries we observed a dip in mid-2020, indicating that some loans did not amortise in that period. And although the proportion of amortising loans increased again in all countries, the pace of recovery was different.

In Portugal, we see a significant improvement only in Q4 2021 when 96% of the loans amortised. After a sharp dip in 2020 for the UK, amortisation stagnated at around 96% in 2021. In Italy, a consistent improvement in every quarter up to Q4 2021 is observed, when approximately 98% of loans amortised.

In Belgium, Spain, and Ireland, we observe a less significant dip in 2020 with almost a full recovery as of Q4 2021.

In Germany, France, and the Netherlands, our data shows an insignificant dip (if any at all) with almost all loans amortising again by the end of 2021.

RMBS Outlook Amidst COVID Uncertainty

Many had feared COVID-19 would spark a wave of mortgage defaults like that of the subprime mortgage crisis, but it seems that the generous support programs from European governments have limited the impact, at least for now.

Nevertheless, there are still uncertainties as to where we are heading with the pandemic and the influence of other macro-economic developments. We at EDW will continue sharing timely insights on any evidence of impact on the performance of various types of loans across the EU & UK.

Please visit our events page to register for EDW’s upcoming Research Update Webinars.