‘Reporting for reporting’s sake:’

Bank of America Commentary Highlights Use Case for EDW Solutions in Reducing Securitisation Reporting Burden

A Bank of America Global Research report commentary, published on 3 May 2022, has explored the complexities and costs associated with the current European securitisation reporting requirements under the Securitisation Regulation (Regulation) and their effects on market recovery, funding, as well as risk transfer.

The commentary, titled ‘Reporting for reporting’s sake,’ highlights the use case for European DataWarehouse’s proprietary ‘Extended Templates’ and ‘CSV2XML Converter’ solutions in reducing the reporting burden for securitisations in the United Kingdom (UK) and across the other European jurisdictions.

It also delves into the current disclosure requirements for public vs private securitisations, the new ECB securitisation notification obligation, as well as the EU vs UK reporting regimes. The report calls for a simplification of the requirements as part of the ongoing revision of the Securitisation Regulation expected later in 2022.

European DataWarehouse has been granted permission to publish the following excerpt:

BOA COMMENTARY: REPORTING FOR REPORTING'S SAKE

One of the main building blocks of the European securitisation regulation is the requirement for transparency and disclosure. And it is the base for another key building block, that of due diligence. Investors need information to carry out their due diligence, there is no question about that. And the information is easily and best put to use if provided in a standardised way, hence the introduction of standardised reporting templates. But have standardisation and ease-of-use been achieved? And what clear (or muddy) waters must issuers and investors navigate in search of transparency?

As a reminder, reporting for securitisation transactions has been in place since securitisation deals came into being: as securitisation deals are based on an asset pool, aka collateral, investors want to have information to understand the asset pool and its expected performance.

Over time, conventions emerged as to what information investors would want to see for which type of collateral. Broadly speaking, a convention emerged: stratified (aggregate) data for granular pools and loan level data for non-granular pools to be made available to investors, and detailed historical loan-by-loan pool data to be provided to the rating agencies at least initially as part of the rating process. As an aside, many transactions securitising low credit quality pools provided detailed data tapes to investors upon request in addition to the aggregate data provided in the prospectus – contrary to the broadly held view that low quality pools (e.g. those of US subprime mortgage loans) did not provide detailed information to investors.

Following the GFC, the securitisation reporting requirements were defined by regulation, and in the EU – by law. European securitisation is subject to numerous reporting requirements unlike any other capital markets sector including those similar to securitisation and relying on collateral, i.e. covered bonds. Besides, behind the relatively uniform set of reporting requirements lie many reporting templates differing in format but providing similar content:

ECB VS ESMA VS RATING AGENCY TEMPLATES

Standardised templates for securitisation reporting were introduced by ECB as part of the inclusion of the European securitisation notes in the ECB collateral framework. The market still refers to them as ‘the ECB templates’. Subsequently, as part of the EU Securitisation Regulation (EUSR), another reporting template was introduced (in 2019), referred to by the market as ‘the ESMA template’.

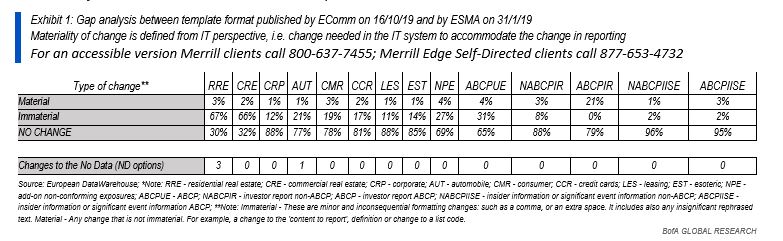

The ESMA template was developed using the ECB template as a base, but the two templates are not fully identical. The table below summarises the degree to which they differ (a gap analysis provided by EDW) in content, with the reference to materiality in difference defined from an IT perspective. There is also a difference in format: XML (Extensible Markup Language) schema of the ESMA template and CSV (Comma-separated Values) for the ECB template, commonly referred to as ‘the Excel template’.

The two templates have been in use in parallel in the last two years: one to report deal pool data to ECB, the other – to ESMA, and both were and continue to be submitted to European DataWarehouse (EDW), now established also as a data repository under the EUSR. EDW introduced a special convertor to allow users to navigate between CSV and XML formats.

Historically, securitisation pool data has been presented on an Excel spreadsheet, which is what most investors and analysts still use, thus creating a natural preference for the ECB template or for receiving reports directly from the originator/ issuer of a securitisation transactions and avoiding the issues arising from using a data converter.

That may explain at least partially the low (as referred to at different conferences) usage of the ESMA templates by investors. The low usage of the templates for some asset classes (e.g. CMBS, credit card ABS) can also be confirmed by the low number of such deals in the EDW transaction coverage list. The other reason may be detailed information contained in the loan-by-loan data files, while investors – at least the ones focusing on senior and senior most tranches – need mostly stratified pool data rather than an exhaustive review of individual idiosyncratic risks in the asset pool.

From a practical point of view, the ESMA template replaced the ECB template as of 1 Oct 2021 for deals in scope of EUSR, i.e. deals issued on or after 1/1/19 and including STS deals. For deals not in scope of EUSR (i.e. deals issued prior to 31/12/2019) that replacement should happen by 30 Sep 2024, i.e. ‘the legacy deals’ are grandfathered to use ECB template until then. So for the time being, the two templates will continue to run in parallel, creating an extra burden for (ironically) the regular issuers.

We note that originators/ issuers have to submit reports to the rating agencies, both prior to issuance and regularly during the life of the securitisation deal. The format of that submission may be different from the templates above, which adds to the cost of issuing a securitisation deal and running a securitisation programme. We understand that EDW has proposed an extended template to satisfy the needs of rating agencies, investors and regulators, or to put it differently: a template that reconciles into one the three templates currently in use for the purposes of ECB, ESMA and the rating agencies.

PUBLIC VS. PRIVATE SECURITISATION REPORTING

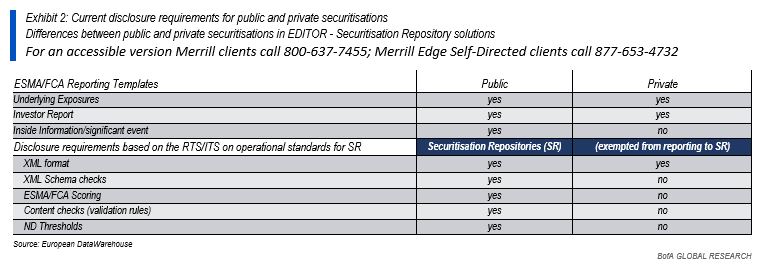

As we understand it, the required reporting to the securitisation repository (SR) for public and private deals differs. Public deals must use reporting templates for A) underlying exposures, B) investor report and C) insider information/ significant event report, while the latter is not required for private deals. While both public and private reporting must use the XML format, public deal reports are subject to XML Schema checks, scoring, content checks and ND thresholds by the SR, while private deals are not subject to them given that they are exempt from reporting to SR. The table below sourced from the EDW Spring Workshop series, Italy, 23 March 2022 provides that summary in more detail:

We understand that at present there are regulatory templates for private securitisation notification: the first being that of the (UK) FCA which template, we understand, was used as a basis for the development of the (Dutch) AFM template for private securitisations. Given that private securitisations are growing rapidly in numbers (in some jurisdictions they outnumber the publicly executed deals), the private securitisation notification templates will likely expand geographically. We understand that a private deal notification report is submitted to the regulators only at pricing (or date of signing, in the absence of a clear pricing point in time), according to information on the AFM website.

As an aside, the question about definition of public vs private securitisations and their reporting to regulators and onto SRs is now under discussion. There is a real possibility that some expansion of the definition of public securitisation (e.g. a deal with a prospectus vs a deal registered on an exchange) may take place and will inevitably capture into the next of the public securitisation template reporting some deals currently defined as private for reporting purposes.

ECB SIB vs ESMA ALL ORIGINATOR / SPONSOR NOTIFICATIONS (BoE vs FCA TEMPLATE)

A new ECB securitisation notification template entered into force on 1 April 2022 with a six month phase-in period until 1 Oct 2022. The notification must be submitted by the originator or sponsor of the securitisation transaction to ECB ‘no later than one month from the date of origination’ of the respective securitisation transaction.

The notification must include information in the following four sections: A/ key transaction information, B/ information on securitised exposures, C/ information on securitisation positions, D/ compliance with articles 6, 7 and 8 of EUSR. The information is provided at origination; however, the originator or sponsor are expected to notify ECB without undue delay of any significant event affecting or likely to affect the features of transactions during its life, particularly in relation to compliance with EUSR Article 6-8.

If we understand it correctly the above notification (with its A, B, C and D components) applies only to securitisations executed by SIBs (systemically important banks, supervised directly by ECB/SSM) in the Euroarea and is in addition to the ESMA notifications A, B and C above which apply to all EU originators/ sponsors of securitisation. In other words, the SIBs in the EZ will be subject to two sets of (perhaps broadly overlapping) reporting templates.

As an aside, we understand that similar information must be submitted (possibly in a somewhat different format) also under COREP (Common Reporting Framework) to EBA as part of the CRR reporting requirements.

A similar contradiction/nuisance/challenge exists in the UK, where securitisation reporting must be submitted to BoE (following the ‘ECB format’) and to FCA (following ‘ESMA format’). While the reporting standards/ templates under ECB and ESMA are on track to converge fully by October 2024 as mentioned above, we are not aware of a similar effort in the UK: for the time being, BoE and FCA templates are expected to remain as they are, i.e. different.

EU VS. UK REPORTING

As of 1 April 2022 UK originators/sponsors/SSPE and UK investors of UK securitisations must use UK securitisation reporting templates (the EU reporting templates are no longer applicable to UK transactions and UK investors for purposes of compliance with the UK securitisation regulation – UKSR).

According to a note by the law firm Morgan Lewis: while the UK Securitisation Regime has been in place from the end of the Brexit transition period, the ‘Temporary Transition Power’ (TTP) allowed the UK regulators to put in place certain transitional provisions enabling UK regulated entities to choose whether to comply with certain rules under the UK Securitisation Regulation regime or to continue complying with the equivalent rules under the EU Securitisation Regulation regime for a temporary period (the TTP period).

As the TTP Period came to an end on 31 March 2022 so as of 1 April 2022 UK originators/sponsors/SSPEs/investors must use the FCA published UK schemas for securitisation reporting.

According to EDW (which is registered as a securitisation repository both in the EU – ESMA Securitisation Repository as of 25 June 2021, and in the UK – FCA Securitisation Repository as of 17 January 2022) the key changes in the updated UK schemas are related to the removal of EU names and references. We understand that at present material differences exist only in the Corporate Securitisation reporting template (i.e. SME securitisations).

As an aside, we note that the FCA schema retain the XML format with all the issues that entails as highlighted above.

When the originator/sponsor/SSPE is established in the UK or EU, it is clear that they must use the respective – FCA or ESMA, reporting template. What is unclear is the acceptable reporting when the above entities are established in a third country (outside the EU or outside the UK). As per above-referenced note by Morgan Lewis: under article 5(1)(f) of UK Securitisation Regulation where the originator, sponsor or SSPE is established in a third country (i.e. not in the United Kingdom) a UK institutional investor will need to verify that such entity has made available information that is substantially the same (italics ours) as that which it would have made available in accordance with Article 5(1)(e) if it had been established in the United Kingdom with the same frequency and modalities. The meaning of ‘substantially the same’ is subject to interpretation and ongoing debate and is not new at all: the issue of acceptable reporting for third country securitisation has been debated since before the introduction of EUSR on 1/1/2019.

To make matters even more complicated, in some securitisation transactions some parties may be bound by the EUSR and others – by the UKSR; this requires dual compliance and related dual reporting.

Questions arise as to for how long the dominant similarities (if not sameness) of the EU and UK reporting regulations/ templates will remain in place. The potential for divergence exists and may start transpiring as early as next year.

Another complication that may emerge in the future is that of interpretation of the existing regulations. At present, the markets rely on ESMA Q&As for clarifications about the use of the templates, and such clarifications by ESMA are usually applied to the FCA templates, too. If and when FCA starts publishing its own Q&As, it is not inconceivable that the same/ similar texts in the UK and EU regulations can trigger different interpretation and guidance by the FCA and by ESMA.

| IN CONCLUSION

The reporting burden for securitisation is increasing and becoming more complex: use of different format, many reporting templates to many reporting recipients, divergence in the both format and content when reporting to regulators, rating agencies and investors, etc. To illustrate just one aspect of the divergence, using the language of EDW, the European markets now needs EDW CSV2XML Converter tool in EU and UK respectively, but it may need – we argue – more such converter tools in the future: possibly ESMAXML2FCAXML, 3CCSV2ESMAXML and 3CCSV2FCAXML, to name but a few, and these tools will further require schema checks, scoring, validation, field comparability analytics, ND thresholds and analysis thereof…

The problem is that securitisation reporting in Europe creates disincentives for securitisation, it is adding new layers of cost, while the benefits of such diverging, extensive securitisation reporting are not clear.

We think that several key questions remain unanswered and must be addressed jointly by the regulators and the markets:

- What is the cost/benefit of the current securitisation reporting standards in Europe? Does the market benefit from the existing standards – why and why not?

- How is securitisation reporting in Europe different from that of other, often more developed than Europe, securitisation jurisdictions and why? Do the differences support or constrain securitisation market development in Europe?

- Has the current reporting been made use of, how and by whom? What constrains the usage and the usability of the current securitisation reporting?

- Why isn’t there comparability between reporting for securitisation and for other collateralised obligations, i.e. covered bonds, loan pools, etc.? Should there be a data repository for such transactions similar to the securitisation repositories?

- Can there be an ‘extended’ (to use the term applied by EDW) reporting template (for rating agencies, investors and regulators) across Europe? Can it resolve the third-country securitisation problem within Europe and across the world?

We hope that the ongoing review of the European securitisation regulations and expected review of the UK securitisation regulations will address these questions, among many other.

Reprinted by permission. Copyright © 2022 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided “as is” and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

Under no circumstances shall BofA Securities or affiliates be liable to you or any third party for any damages (including but not limited to direct, indirect, special and consequential damages), losses, expenses, fees, or other liabilities that directly or indirectly arise from this license, the Report or the Content or your use of the materials. You hereby waive and release BofA Securities and affiliates from any claims for damages, losses, expenses, fees, liabilities, causes of action, judgments and claims arising out of or related to your use of the Report or the Content, whether now existing or arising in the future.

You recognize that information contained in the Content or Report may become outdated and that BofA Securities and affiliates are under no obligation to update the Content or Report or notify you of any changes to the Content or Report. The Report and Content are provided “AS IS,” and none of BofA Securities and affiliates make any warranty (express or implied) with respect to the Report or any content including the Content, including, without limitation, any warranty of ownership, validity, enforceability or non-infringement, the accuracy, timeliness, completeness, adequacy, merchantability, fitness for a particular purpose, or suitability of the material for any intended audience.