ESMA’S Sustainable Finance Roadmap and the significance of Energy Performance Certificate Data

The European Securities and Markets Authority (ESMA) recently published its Sustainable Finance Roadmap 2022-2024 (Roadmap), identifying three priorities for its sustainable finance work:

- Tackling greenwashing and promoting transparency;

- Building National Competent Authorities’ (NCAs) and ESMA’s capacities in the sustainable finance field; and

- Monitoring, assessing, and analysing ESG markets and risks.

At the same time the Financial Stability Institute, part of the Bank for International Settlements, has published Brief No. 16 focusing on the “Regulatory response to climate risks: some challenges.”

Monitoring, assessing, and analysing ESG markets and risks with EPC data

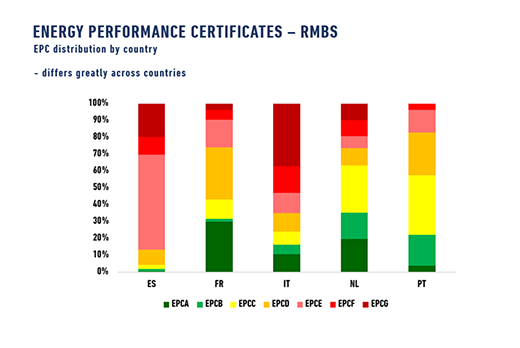

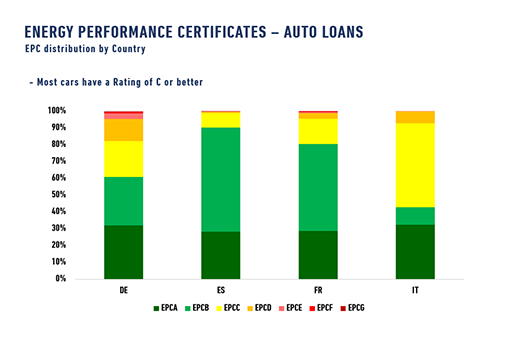

European DataWarehouse (EDW) collects a wealth of sustainable finance information, including energy performance certificates (EPCs) for residential mortgages and auto loans. This growing dataset, thanks to the ESMA and FCA exposure templates, now comprises 1.2 million records for auto loans and 0.5 million for mortgages.

Such datasets can be used for a variety of credit risk and correlation analysis and could help to answer some of the following questions:

- Is a driver of a low emission vehicle less likely to default compared to a driver of a second-hand car?

- Is the borrower behaviour of a homeowner with a sustainable building more favourable when up against inflation and energy price increases?

- Is the residual value assigned to electric/hybrid cars improving every year compared to diesel/petrol cars?

Standardised data the key to a transparent securitisation market

EDW boasts a dataset dating back to 2013 and, in addition to auto and RMBS asset classes, it also encompasses SMEs, consumer loans, credit cards, and leasing ABS transactions across the major European jurisdictions.

Over the years, EDW has collected more than 3 billion periodic loan records for more than 100 million loans where each loan record contains information on different fields showing borrower, collateral, and loan level information. The number of fields (between 60 and 150) varies across asset classes (loan types) and there is a standardised taxonomy for each asset class that defines each field.

Moreover, data submitted to EDW each day has a lag of 40 days on average (i.e. the difference between the data submission date and the data as of date). This means any performance impact on millions of loans across Europe can be analysed within a month or two.

Please contact us for more information on credit trends or for a demonstration of our data solutions. You can also register for our next Research Update Webinar by visiting the events page of our website.