COVID & Credit Risk – EDW Explores Implied Moratoria Across Different Borrower Categories

How has the impact of COVID-19 differed amongst various borrower segments within the RMBS asset class? Our research shows that the criteria used to identify the loans most likely to default (credit risk) also apply for identifying the loans most likely to have obtained a moratorium.

We have identified the moratoria in our loan-level database using the method described in our report, “Monitoring the Impact of COVID:19 Q1 2021 RMBS.” Namely, we consider “moratorium due to COVID-19” as those mortgages where any of the following modifications were observed since March 2020 and not before:

- Instalment decrease of at least 50%

- Increased current balance implying capitalisation of interest

- Extended maturity date

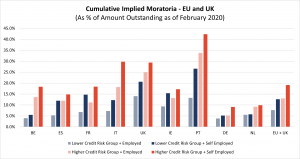

To find the percentage of loans modified due to COVID-19 in a given mortgage segment we then compared the cumulative amount of modified loans with the outstanding balance of these loans as of February 2020. These segments take country, employment type, and credit risk into consideration.

Credit risk categories are classified as follows:

- “Lower Credit Risk” loans are those featuring all three of the following characteristics 1) Debt service to income less than 20% and 2) Current debt less than twice the yearly income and 3) CLTV less than 80%.

- “High Credit Risk” loans are those featuring all the following characteristics 1) Current debt service to income more than 20% and 2) Debt more than twice the yearly income and 3) CLTV more than 80%.

This chart shows the cumulative % of implied payment holidays, or moratoria, among four categories of mortgages in the EU & UK:

In summary, we found that:

- In all countries, the category “Higher Risk Self-Employed” shows the highest loan modifications implying moratoria

- On the other hand, the category “Lower Risk Employed” shows the least implied loan moratoria in all countries

- When comparing “Higher Risk Employed” to “Lower Risk Self-Employed”, we find that the levels are often of a similar magnitude.

This is just one of the insights we’ll discuss in our upcoming Summer Research Update, which will focus on loan performance across the RMBS asset class. Register for the webinar on Wednesday 1 September @ 16:00 CEST here. You can also visit our Events page to register for a number of other events coming up.